uk statutory sick pay

1 An eligible employer who has made a payment of statutory sick pay 2 to an employee where. Covid Statutory Sick Pay is a weekly amount for employees who contract or have to self-isolate because of the Covid-19 virus.

|

| Statutory Sick Pay Ssp Rates 2021 22 Iris Fmp |

Open Monday to Friday 8am to 4pm.

. Employees only receive payment for qualifying days days they would have worked had they not been ill and sick pay must be included in their regular payslip. Theyve told their employer within any deadline the employer has set or within. Statutory sick pay means that eligible people could receive 9635 per week paid by their. By law employers must pay Statutory Sick Pay SSP to employees and workers when they meet eligibility conditions including when.

It makes no difference whether your employee is full- or part-time. This is not a new issue though with the 2017 Taylor Review highlighting the need for regulatory changes to support people with long-term health conditions to remain in. The end of relevant period is the last payday before the employees first sick day. Weekly rate of Statutory Sick Pay number of qualifying days in a week x working days worker is ill -3 As an example imagine that an employee earns more than 123 a week and is contracted to work from Monday to Friday.

A that employees period of incapacity for work 3 is related to coronavirus. The Budget 2020 revealed that SSP would apply to those affected by coronavirus. To work out how much they are entitled to exactly the government has provided this helpful Statutory Sick Pay Calculator. The statutory amount is the minimum amount that employers must pay employees off sick for up to 28 weeks but they may choose to pay their staff more.

The Bradford Factor allows managers to monitor. An updated form SC2 for employees who have been sick for 4 or more days in a row and need to claim Statutory Sick Pay SSP from your employer has been published. To understand how to calculate SSP you can use the following formula. SSP like normal wages is paid by your employer and at the same rate.

Statutory Sick Pay is a benefit paid by employers to someone who is too ill to work. In order to benefit from the entitlement to statutory. The Government has indicated that the rate of payment for statutory sick leave will 70 of normal wages up to a maximum 110 per day. 10 July 2014 Added translation.

How do you claim statutory sick pay. For example if your wage is paid to you in a weekly manner your SSP will be paid to you weekly. Statutory Sick Pay and an employees claim for benefit. Casual short-term and zero hour contracts.

If you think youre entitled to statutory sick pay but your employer says youre not and refuses to pay it you should contact HM Revenue and Customs HMRC or HMRCs Statutory Payments Disputes Team. Individuals who are classed as employees for the purposes of SSP and are on casual short-term or zero-hours contracts are eligible for SSP as long as. Record sheet SSP2 4 April 2014. If your employee earns above the lower earnings limit which currently stands at 11800.

Theyve been off sick for at least 4 days in a row including non-working days. The weekly rate for Statutory Sick Pay SSP is 9935 for up to 28 weeks. It may be that you already record sick leave data and therefore will be able to set your own average. This is for any qualifying days if your employee earns enough to have this entitlement.

Or you can base it on the average in your sector. Employer form SSP1. You can base it on the national average of sick days per year in the UK 44. It is paid to you by your employer in the same way your normal wages would have been paid.

Remember that in order to be eligible for statutory sick pay SSP an employee must have average weekly earnings of 123 or more for 20222023 within a relevant period. B any day of incapacity for work in that period falls on or after 21st December 2021 is subject to paragraphs 2 and 3 entitled to recover the. The employer can opt to furlough an employee and claim for a sick employee on furlough terms under the Coronavirus Job Retention Scheme see below. The minimum you are legally required to pay during periods of sickness is Statutory Sick Pay SSP.

To qualify for Statutory Sick Pay SSP employees must. Statutory sick pay in the UK can be paid for up to 28 weeks starting from an employees fourth day of absence. They fall ill and call in sick on Monday 4th. How you claim statutory sick pay is usually dependent on your employer but usually you will need to let them know within seven days.

The current rate of SSP from 6 April 2020 is 9585 per week which increased from 9425 per week. The minimum amount is 9635 but your employer may pay more. The Regulations may specify the percentage rate of an employees pay up to a maximum daily amount at which statutory sick leave payment will be paid. The vulnerability of many workers forced to rely on Statutory Sick Pay SSP during COVID-19 or not being able to access it at all exposed the fault lines in the UK system.

They earn on average at least 123 a week before tax. The start of the relevant period is the day after the last payday at least 8 weeks prior. Reclaim statutory payments or. This is a rise of 31 per cent which is below the current rate of inflation at 62 per cent.

In the United Kingdom statutory sick pay SSP is paid by an employer to all employees who are off work because of sickness for longer than 3 consecutive workdays or 3 non-consecutive workdays falling within an 8 week period but less than 28 weeks and who normally pay National Insurance contributions NICs often referred to as earning above the Lower Earnings Limit LEL. For the days an employee normally works - called qualifying days. You must pay SSP if any worker or employee who is eligible for SSP has to self-isolate because. The statutory sick pay rules change from March 24and the change will impact those who get Covid.

This is commonly known as a sick leave entitlement. In the same way as wages for. However since the minimum wage in the UK is 770 per hour and an average workweek is 40 hours long the mandated amount falls far short of earnings 9425 compared with 308 per week even on minimum wage. If you are eligible the amount of Statutory Sick Pay you are able to get is 9635 per week.

The government increased the rate of statutory sick pay on April 1 from 9635 per week to 9935.

|

| Statutory Sick Pay Ssp Moneysoft |

|

| Statutory Sick Pay Highland Payroll Services |

|

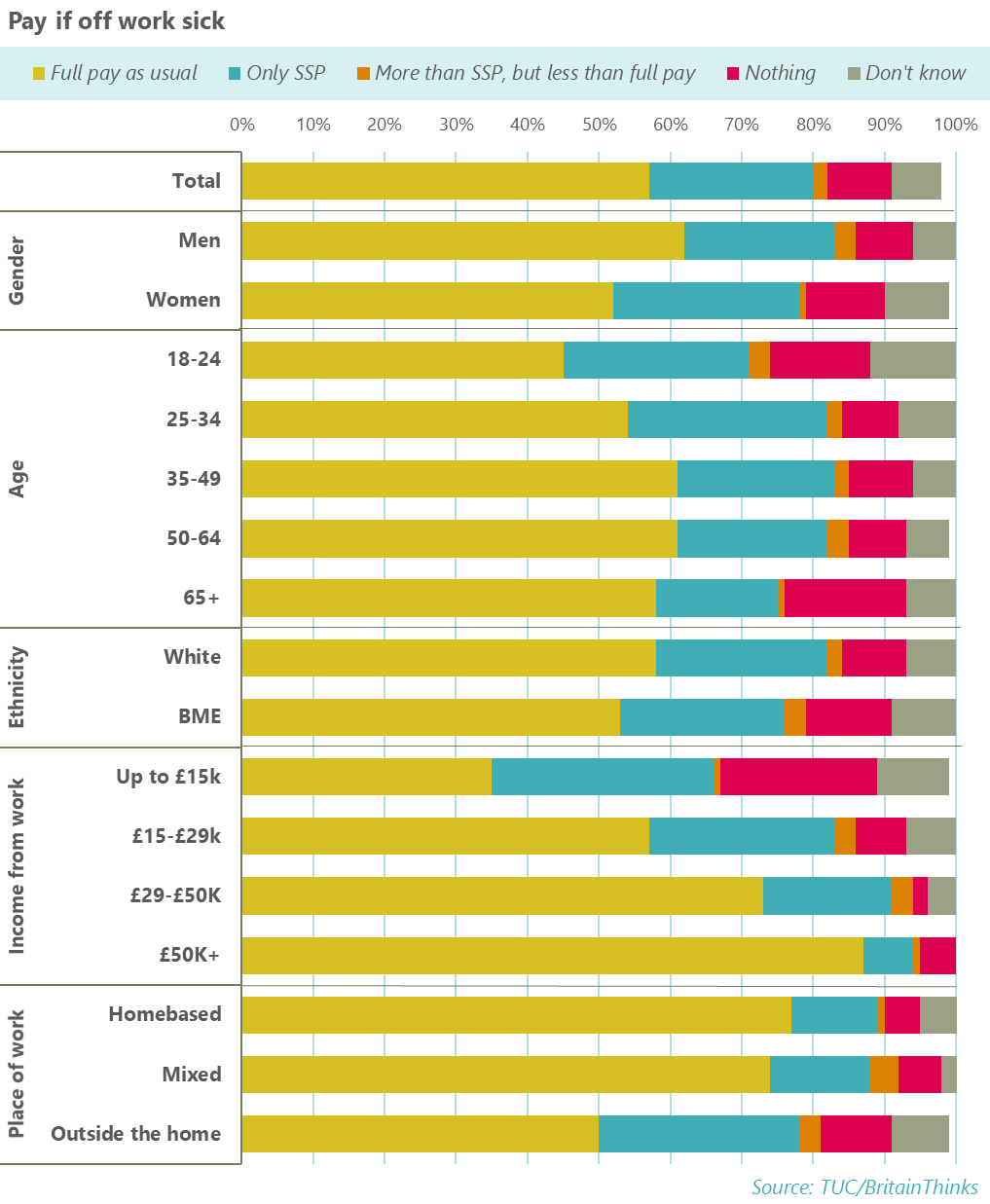

| Sick Pay And Debt Tuc |

|

| Coronavirus Uk S Inadequate Statutory Sick Pay Rate Among Lowest In Europe The Independent The Independent |

|

| Statutory Sick Pay Normal Sick Leave Brightpay Documentation |

Posting Komentar untuk "uk statutory sick pay"